If you understand what this professor, Professor Richard Wolff is saying to correspondent Lena Petrova, then you know it is about time to get a passport, consolidate with like-knowledgeable peers or groups, to live both here in the US and in one of the southern basin countries of Africa (AZZNBS). AZZNBS stands for Angola, Zambia, Zimbabwe, Namibia, Botswana, and South Africa.

Watch Video

First concern is the national US debt!

The United States’ trillion-dollar debt, now exceeding $30 trillion, has accumulated over decades due to persistent budget deficits, economic crises, and tax policies. Historically, the debt began to rise significantly post-World War II, but it surged particularly in the 1980s, 2000s, and during the financial crises of 2008 and 2020.

The national debt consists of public debt, borrowed from external investors, and intragovernmental holdings, primarily from Social Security and other trust funds. Contributing factors include continuous budget deficits, funding wars, large-scale economic stimulus packages, and tax cuts (on the super rich) that reduced federal revenue.

To address the debt, the US plans to implement fiscal responsibility measures such as spending cuts, increasing revenue through higher taxes on the wealthy and corporations, and promoting economic growth through investments in infrastructure and technology.

Entitlement reforms and stricter budget controls are also proposed, though these measures face political and economic challenges. Political gridlock often hampers comprehensive debt reduction strategies, and rapid fiscal adjustments could risk economic downturns.

The Federal Reserve’s monetary policy plays a role by influencing borrowing costs and economic conditions. Ultimately, addressing the national debt requires a balanced approach combining fiscal discipline, economic growth, and political cooperation, contingent on the prevailing political and economic landscape.

Concern number two, industry against foreign business.

The United States has imposed various taxes and tariffs on semiconductors, raw materials, and other products to protect domestic industries, address national security concerns, and counter unfair trade practices. Semiconductors, vital for electronics and defense, have seen tariffs and export controls, especially targeting China to curb intellectual property theft and subsidies.

The US-China trade war led to extensive tariffs on Chinese goods, while other countries faced similar measures for dumping and unfair subsidies. Tariffs on steel, aluminum, and rare earth elements aim to secure critical materials and bolster domestic production. These measures are intended to protect US industries and jobs, ensure a reliable supply of essential technologies, and strengthen national security. However, they also lead to complex trade relations and retaliatory actions from other nations.

Sanctions against competitors or nations who don’t play by US rules is conflict number three.

The United States uses secondary sanctions to extend the impact of its primary sanctions, which target countries like Iran, North Korea, and Russia for reasons such as nuclear proliferation and human rights abuses. Secondary sanctions penalize non-US entities that conduct significant business with these sanctioned nations, deterring global companies and financial institutions from engaging with them.

This approach aims to economically isolate the targeted countries and amplify pressure on them to change their behavior. Administered by the US Treasury’s Office of Foreign Assets Control (OFAC) and supported by legislation like the Countering America’s Adversaries Through Sanctions Act (CAATSA), these sanctions are a powerful tool but can strain international relations and disrupt global trade.

Concern number four, is the depleting middle class in the US.

Radical and extreme capitalism in the United States, marked by unregulated markets, aggressive profit-seeking, and minimal government intervention, has led to a significant wealth gap and the erosion of the middle class. Policies from the 1980s, like Reaganomics, focused on tax cuts for the wealthy and deregulation, particularly in the financial sector, fostering wealth concentration among the top 1%. Meanwhile, wage stagnation has affected the middle and lower classes due to the decline of labor unions, job outsourcing, and the rise of gig work.

Corporations, prioritizing short-term profits, engage in practices like stock buybacks and offshoring, benefiting shareholders and executives while harming employees. Market monopolization has reduced competition, making it tough for small businesses to thrive. The middle class faces job insecurity and rising costs for essentials such as healthcare, education, and housing, eroding disposable income and savings.

Wealth concentration also translates into political influence, skewing policies in favor of the affluent. Critics advocate for reforms like progressive taxation, stronger labor rights, higher minimum wages, and robust social safety nets to combat income inequality and support the middle class.

Based on this, what is the economic prognosis for the next 5, 10, 20 years out for the US?

The economic outlook for the United States over the next 5, 10, and 20 years involves a mix of opportunities and challenges. In the next five years, the economy is expected to recover from the pandemic, driven by consumer spending, government stimulus, and business investments, although inflation and income inequality may remain concerns.

Over the next decade, technological advancements like AI and automation will boost productivity but could displace jobs, requiring retraining efforts. An aging population will strain social security and healthcare, while climate change and energy transitions will shape economic policies and opportunities. Looking twenty years ahead, economic inequality might worsen without significant reforms, potentially leading to social unrest.

Sustainable growth will depend on innovation, productivity improvements, and global competitiveness. The US will need to invest in education, infrastructure, and research to maintain its economic leadership. Proactive policies will be essential to ensure broad-based economic benefits and a strong middle class.

All of this means if you are living in the US, you have to make the changes to your lifestyle now. You have to prepare financially to the changes happening domestically and internationally. If not, you will be totally blindsided by the upcoming events that will soon take place.

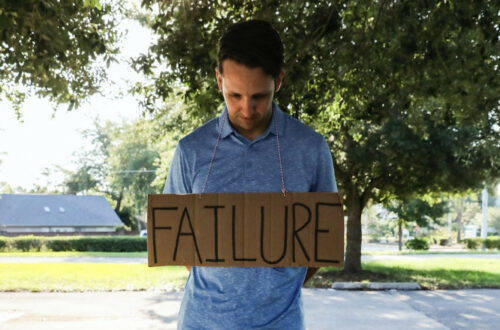

Unfortunately, the US is becoming a failure system. Welcome to the Failure System.

Dr. Fayalar

TheFailureSystem